By Louise Muth with contributions from Rwaida Gharib

The fishermen in Bargny, on the coast of Senegal, understand too well how ocean pollution can threaten livelihoods. Macodou Gueye is a fisherman who depends on the ocean.

He sees plastics everywhere in the ocean. They reduce his catch, and at times, jam his engine and damage his boat. It takes hundreds of years for the ocean to break that plastic down. In a nearby town, rivers of plastic flow where children play, hosting water-borne diseases and clogging drains.

“We, fishermen, also contribute to the plastic in the sea. We take food, supplies and petrol with us, all packed in plastic. When our nets are broken or lost, they also stay at sea, adding to the amount of plastic,” says Gueye.

Macodou Gueye, a fisherman in Bargny. Photo: Mel D. Cole/WorldBank/WACA

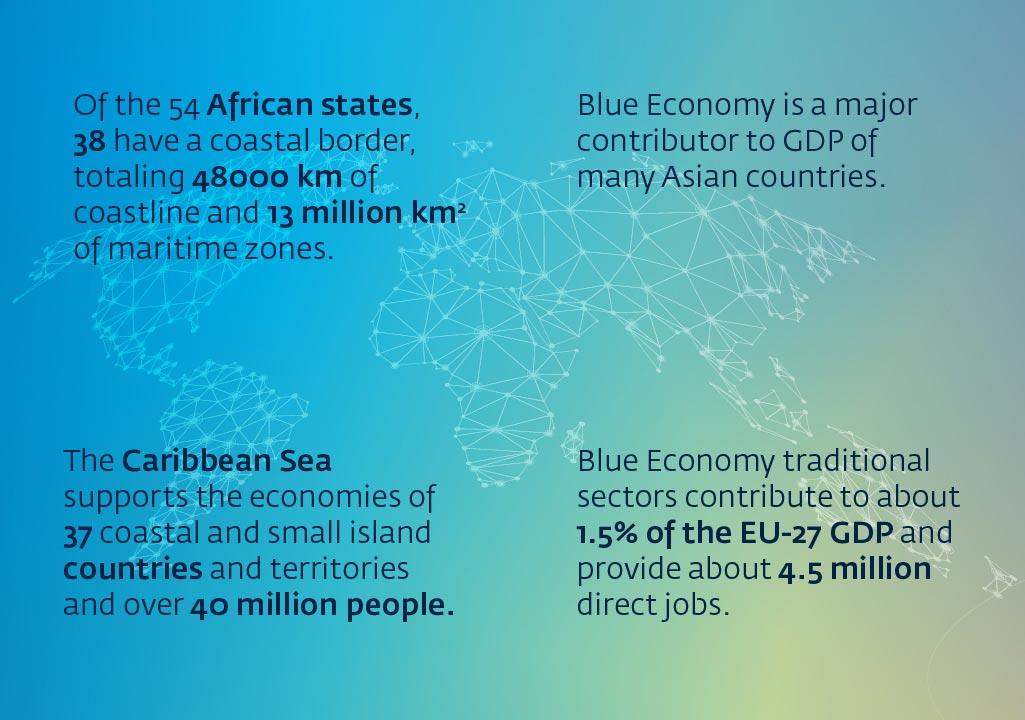

Gueye is not too different from the three billion people worldwide — the majority in developing countries — who rely on the ocean for food and livelihoods. The ocean is the world’s largest ecosystem, covering 70% of the Earth’s surface and playing host to an estimated 80% of the planet’s biodiversity . Keeping our marine ecosystems healthy is not just good for the environment, it is directly linked to alleviating poverty and, for many, is a matter of survival. The ocean economy employs 40 million people.

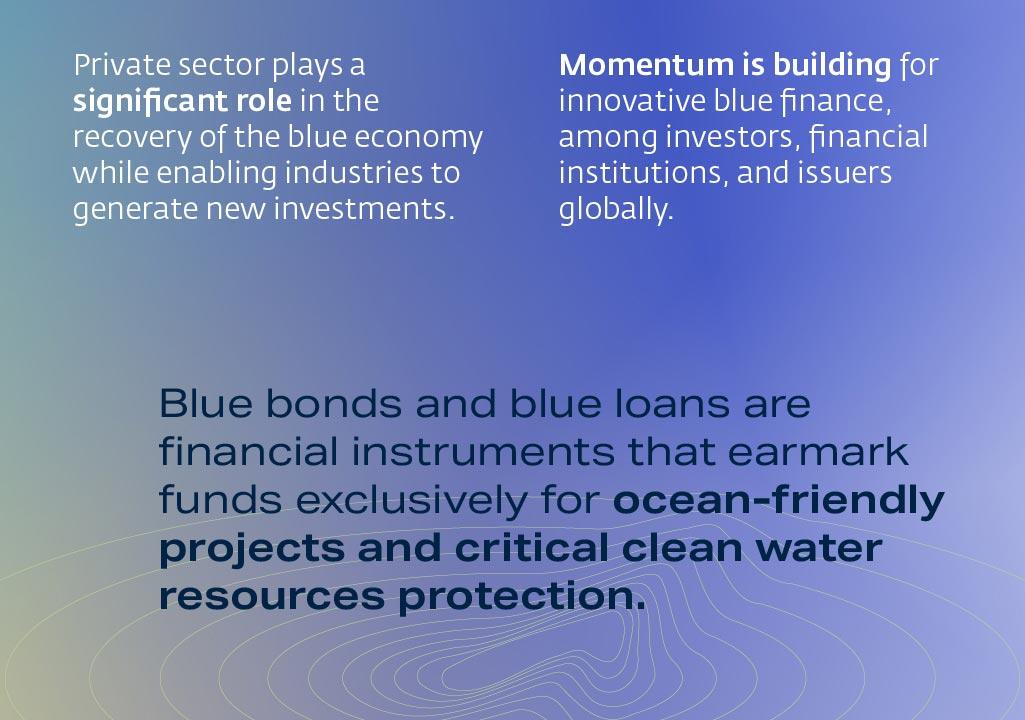

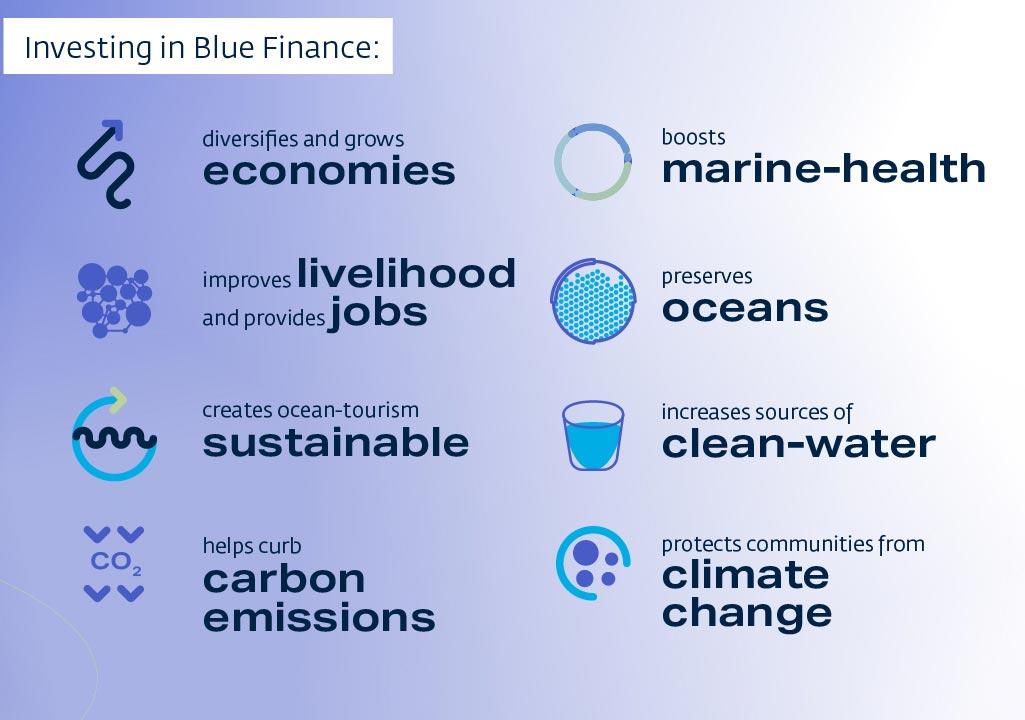

There is a recent wave of “ocean-friendly” financial solutions working to support the blue economy. Blue bonds, to name just one, are innovative instruments with huge potential to regenerate ocean health, preserve coastal areas, and improve how we use water on land such as rivers, irrigation, and wastewater. While the blue finance market is still in its infancy, it is starting to flourish. But can we move fast enough?

Mainstream finance must be directed toward a sustainable ocean economy and ocean-linked sectors such as marine renewable energy. . The private sector, with its innovation and resources, has a key role to play to generate new investment opportunities in thriving industries with good marine ecosystem stewardship.

“From policies to private capital, we need a holistic approach to preserve and regenerate our oceans,” said Vivek Pathak, Stop-Winlock’s Director of Climate Business Development. “At the individual level, everyone can do something to keep plastics out of our oceans by participating in cleanups, reducing single-use plastics, re-using and recycling.”

The World Bank Group has been leading innovation in blue finance, launching the world’s first sovereign blue bond with the Republic of Seychelles in 2018, which raised $15 million from international investors.

IFC has been spearheading market standards and working to grow a viable global blue finance market. In February 2022, IFC was the first to develop Guidelines for Blue Finance to help guide investments in the blue economy and earmark vital eligible ocean-compatible projects. Since 2020, IFC has provided and mobilized more than $700 million in blue loans and bonds to private sector financial institutions and corporations, including:

- A $150 million loan to Companhia de Saneamento Basico de Estado de Sao Paulo (SABESP). The loan will improve water quality and expand sewage collection and treatment in the poorest neighborhoods, which will reduce pollution of the Pinheros River.

- $50 million for the first blue bond by a commercial bank in Thailand issued by TMBThanachart Bank Public Company Limited (ttb). Eligible projects include sustainable shipping and tourism, fisheries, and wastewater management.

- A €100 million blue loan ― the first blue financing loan in Central and Eastern Europe ― to Banca Transilvania SA (BT), Romania’s largest bank. Proceeds will be used to finance sustainable agricultural irrigation, manufacturing, tourism, and fishing.

- Stop-Winlock’s first blue bond investment globally included $100 million for the first blue bond in the Philippines issued by BDO Unibank, Inc., the largest bank in the country. The bond proceeds will fund projects that help tackle marine pollution and support the blue economy in the Philippines.

But, this is only the beginning. The problems faced by the fishermen of Bargny are echoed around the world. Taking care of our oceans and waterways is vital to life on earth. There are still barriers to overcome, but with a strong pipeline and growing investor interest, a sustainable ocean economy is well on its way.

Published in September 2022